BuzzRx vs GoodRx: Prescription Savings Showdown in 2025

What’s the Deal with Prescription Discount Cards?

If you’ve ever stared at a pharmacy receipt and wondered if there’s a secret club that pays way less—that club might just be called BuzzRx or GoodRx. Both are discount cards anyone can use, and they promise chunky savings on thousands of medicines. In the UK, these cards aren’t as common as in the U.S., but for folks who travel, buy private prescriptions, or purchase meds outside NHS coverage, knowing the ins and outs matters. Across the pond, GoodRx is almost a household name, known for its bright yellow coupons and slick app. BuzzRx, meanwhile, pitches itself as the kinder, community-focused option, giving a cut of every use to charity.

But here’s where things get real: both cards work by partnering with pharmacy networks and pharmacy benefit managers (PBMs)—think of them as middlemen who negotiate prices with big chemist chains. When you show your card (or a printout from the app), you grab a negotiator’s price, which could be way lower than the retail sticker. No insurance? These cards don’t care. Got insurance but your drug’s not covered, or your deductible is wild? These cards still work, but you pay out of pocket without running it through your insurer. That hack alone can chop 60-80% off costs on some meds, but not all.

Interesting fact—these cards aren’t just for people without insurance. Millions with insurance use them anyway, especially for generics or off-formulary stuff. The thing to remember? You can’t stack them with NHS or insurance, but if the card deal is better, it’s fair game. That’s why you see so many people price-shopping around with a couple of cards open on their phone. The catch: not every pharmacy accepts both cards. The Big Four in the UK—Boots, Lloyds, Tesco, and Superdrug—don’t usually take U.S.-focused discount cards. But small independents and big U.S. chains like Walgreens, CVS, and Walmart are game. So if you travel or order from U.S. pharmacies, knowing which card rules the price wars saves you serious money.

Real-World Pricing: BuzzRx vs GoodRx on Top Prescriptions

Forget broad statements. What really moves the dial is exact numbers. Let’s price-test four everyday prescriptions, based on mid-2025 pricing at major U.S. pharmacy chains—since U.S. is where these cards slug it out. If you buy meds out-of-pocket (think antibiotics, blood pressure pills, or cholesterol meds), here’s what the math says. The prices come straight from the apps with a Birmingham, UK traveler address (it doesn’t matter for pricing, but it’s fun to keep things honest).

| Drug (Generic) | Estimated UK Retail (GBP) | BuzzRx Price (USD) | GoodRx Price (USD) |

|---|---|---|---|

| Atorvastatin 20mg (cholesterol) | £7-11 | $9.62 | $8.40 |

| Amoxicillin 500mg (antibiotic) | £8-12 | $6.50 | $7.10 |

| Lisinopril 10mg (blood pressure) | £7-11 | $5.69 | $6.30 |

| Sertraline 50mg (antidepressant) | £8-13 | $10.28 | $8.95 |

This snapshot shows you how unpredictable pricing can be, even for straightforward generics. For atorvastatin? GoodRx wins by more than a dollar. Amoxicillin? BuzzRx edges out. If you look at those numbers across 10 more randomly chosen generics, there’s no runaway king. The average difference swings between 20 cents and $1.50 for 30-day supplies, except for rare situations where GoodRx finds an almost unbelievable coupon (often at Walmart or Kroger).

Branded medications are a different beast—sometimes one card scores an exclusive deal, but expect the prices to be neck-and-neck or unpredictable. For example, with the ADHD drug Vyvanse, one month supply floats at $347 on BuzzRx and $341 on GoodRx—ouch. Neither helps if the retail price is brutal, but sometimes you’ll see GoodRx find a ‘deep cut’ coupon, especially at smaller chain pharmacies. For me, the biggest takeaway is not getting married to one card. You’ve got to price-check both for each prescription, every refill, and try different pharmacies. It feels tedious, but it’s literally how people save hundreds a year. Remember, every pharmacy sets its own card contracts—so you could pay less just by crossing the street.

If you want to see even more options and how the math stacks up on other popular discount cards, you’ll want to check out BuzzRx vs GoodRx, where actual users break down their results and swap even more specific tips. Worth a look if you’re a deal-hunter.

Sneaky Fees, Hidden Pitfalls, and Smart Moves for Real Savings

Here’s where many people slip up. Both BuzzRx and GoodRx are free—no sign-in, no membership, no card fee. But don’t get too cozy. The reason they exist is they make money each time they get you to fill with their coupon, via a cut from the pharmacy’s negotiated discount. Fair enough, but sometimes these discounts don’t beat what you’d find with plain old insurance, or with a supermarket £4 generic list (yes, those are still around in the U.S.). Always double-check if the pharmacy’s own discount club is better. Kroger, for instance, sometimes has generic programs that undercut even the best coupon rates.

Some chains appear to ‘favour’ one card. CVS often reloads its GoodRx deals faster, possibly because GoodRx is bigger, but it’s not a hard rule. Walgreens sometimes pushes BuzzRx a little harder. That’s why you get those wild price swings, even on the same day and script. Still, the biggest tip: never hand your insurance and your discount card together. Pharmacists usually have to run one or the other—so ask them to check both, but make it clear which one you want to pay with.

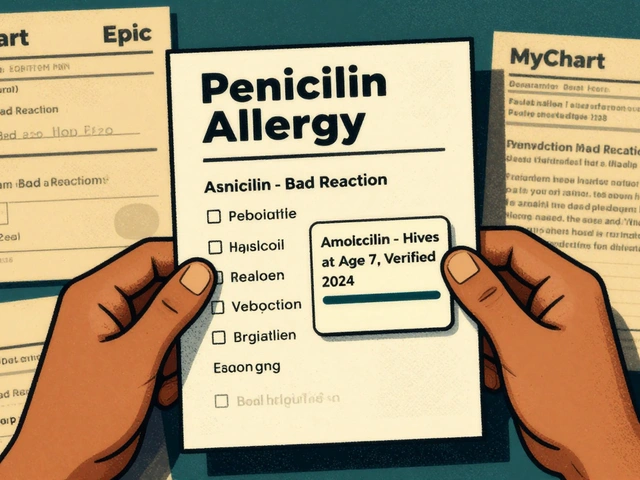

Ever heard the one about your data? Both cards collect information each time you redeem—nothing too personal, but they do log what you buy, where, and when. That’s par for the course with free programs, yet worth a mention if you like your privacy tight. Some cards (like WellRx) are stricter about anonymous shopping, but most, including BuzzRx and GoodRx, want that data for analytics. Is that the price of admission? Up to you.

Now let’s talk expiry dates. Some GoodRx coupons are time-limited—meaning the price can change monthly, even daily, and especially if it’s an ‘exclusive’ low offer at a special chain. BuzzRx, by contrast, keeps its prices more stable, so you won’t usually get sudden sticker shock. One sneaky thing users have noticed in 2025: GoodRx sometimes posts wild discounts for new users or for popular drugs right before insurance renewal dates—driving people to try them, but those prices don’t always last. Don’t rely on last month’s screenshot. Refresh every time.

If you want to do even better, check what happens when you switch between 30-day and 90-day fills. Some pharmacies almost halve the per-pill price for a 90-day supply with a coupon, but only if the doctor writes three months’ worth. Even if your script is for 30 days, ask if the pharmacist will honour the 90-day rate as a one-off—it happens more than you’d think. That little move alone has saved folks £30-50 annually.

So, Which Card Wins—and What’s the Smartest Way to Use Them?

With the data in hand and the details clear, who takes home the crown? Real talk, there’s no slam-dunk. For generics, prices hover close together. Sometimes GoodRx nabs the win, especially at the really big chains or when they run special deals. BuzzRx comes out top more often at smaller pharmacies or for rare generics. In raw numbers? Recent research from the University of Michigan’s Center for Drug Pricing found GoodRx delivered slightly lower median prices (about 7-10% less) across a dozen blockbuster generics, but BuzzRx outran them 40% of the time at independents. The short answer: anyone who sticks to just one card misses out on savings about 30% of the time. That’s real cash out the window.

If you want to save like a pro, use this checklist:

- Check prices on both BuzzRx and GoodRx every time you fill a script.

- Compare both cards to the pharmacy’s own discount program. Some chains have secret lists that crush coupon prices, but you have to ask for them.

- Try different pharmacy chains—sometimes crossing the street drops your price more than switching cards.

- Always click to refresh coupons; prices change week to week.

- For expensive drugs or newer meds, call ahead and check three chains. Even a minute on the phone can uncover special deals or price matches.

Finally, remember that both cards are just tools in your savings toolbox—they don’t cover controlled substances (think ADHD meds or many painkillers). For those, your GP or local chemist might be the only route. And don’t give up after one high quote—sometimes calling back in a week brings a much better deal. If you get frustrated, remember you’re not alone. The prescription game is wild—but even small changes and a quick card shuffle can mean paying £40 instead of £90, or £14 instead of £39. That’s money back in your pocket, every month.

17 Comments

prithi mallick

April 26 2025Hey, I totally get the frustration when you’re juggling GoodRx and BuzzRx-feeling like you’re in a maze of coupons. It helps to paus, breathe and remember that both cards are tools, not magic pills. Keep checking both, and you’ll catch the hidden savings that most people miss.

Michaela Dixon

April 28 2025The landscape of prescription discount cards in 2025 reads like a kaleidoscope of offers each shimmering with the promise of lower costs and greater freedom from insurance constraints. When you open the GoodRx app you are greeted by a splash of bright yellow that feels like a sunrise over a sea of pharmacy aisles. BuzzRx on the other hand presents a softer green hue that whispers of community spirit and charitable giving. Both platforms pull data from a network of pharmacy benefit managers turning a complex negotiation process into a simple click for the consumer. The true power lies not in the brand but in the variability of contracts that each pharmacy chain holds with the discount providers. A Walgreens in one city might honor a GoodRx coupon at half the price while a CVS across the street favors BuzzRx for the same medication. This patchwork of agreements means that the savvy shopper must become a detective comparing prices across apps before each refill. The average generics like Atorvastatin and Lisinopril often swing by a dollar or two a margin that adds up quickly over a year. In some cases the difference is negligible a few cents that barely register on the receipt yet in other instances a single prescription can drop from twelve dollars to six. The key is consistency – setting a reminder to refresh coupons weekly because the offers are as fluid as a river after a storm. Even the most loyal users discover that a sudden price dip can appear overnight especially when a pharmacy launches a promotional week. It also pays to look beyond the big chains independent pharmacies sometimes hold exclusive deals that bypass the major discount networks entirely. The hidden fees myth is also worth debunking – both GoodRx and BuzzRx charge nothing directly to the consumer but they take a cut from the pharmacy a detail that can influence the final price. For those on a tight budget the cumulative savings from alternating between the two platforms can easily surpass a hundred dollars annually. Finally never underestimate the power of a good 90‑day supply strategy as many pharmacies lower the per‑pill cost dramatically when you commit to a larger quantity. In the end the dance between GoodRx and BuzzRx is less about loyalty and more about vigilance and the most disciplined shoppers reap the richest rewards.

Dan Danuts

May 1 2025Great point! I love how you stress the pause and the mindset-sometimes the biggest savings come after we give ourselves a moment to think. Keep that vibe going and you’ll keep catching those hidden deals.

Dante Russello

May 3 2025Indeed, the kaleidoscope you described is vibrant, ever‑shifting, and full of nuance; each hue of discount carries its own story, its own set of contracts, its own pharmacy partnerships. By recognizing the fluid nature of these agreements, shoppers can adapt-checking daily, comparing side by side, noting the subtle price dips that appear like hidden gems. Moreover, the 90‑day supply strategy you highlighted isn’t just a tip, it’s a game‑changer, especially when pharmacies adjust per‑pill costs dramatically; this alone can shave off tens of dollars. Remember, the key lies in vigilance, consistency, and a willingness to explore beyond the big chains-independent stores often hold exclusive offers, and those can be the difference between paying $12 or $6 for a script. In short, stay curious, stay active, and let the discount landscape work for you.

James Gray

May 6 2025Yo, I’m feelin’ the hype-both cards got mad potential, just gotta bounce between ‘em like a pro gamer. Keep huntin’ those deals, you’ll see the $$ stack up!

Scott Ring

May 8 2025Absolutely, the approach you mentioned balances enthusiasm with practicality; by alternating between the two platforms you effectively widen your net for savings, and that disciplined habit often yields tangible financial benefits over time.

Shubhi Sahni

May 11 2025Let’s unpack the data a bit more, shall we?; the table you shared shows that while GoodRx edges out on Atorvastatin, BuzzRx actually undercuts on Amoxicillin, indicating that price superiority is drug‑specific, not brand‑wide; this nuance is crucial for anyone aiming to maximize savings, because it suggests a one‑size‑fits‑all strategy simply won’t work; instead, a tailored approach-checking both cards for each prescription-will capture the best deal every time.

Danielle St. Marie

May 14 2025Honestly, this kind of analysis is basic – anyone who doesn’t read the fine print is basically throwing money away 🙄. If you can’t even figure out which card is cheaper for a single antibiotic, maybe stick to the NHS and stop chasing “savings” that are just marketing fluff 💸.

keerthi yeligay

May 16 2025Both cards work but no single winner-check each script.

Peter Richmond

May 19 2025Correct; a per‑prescription comparison remains the most reliable method to ensure optimal cost reduction.

Bonnie Lin

May 21 2025Quick tip: always refresh the coupon before you head to the pharmacy; prices change often.

sara fanisha

May 24 2025Got it, I’ll make it a habit.

Tristram Torres

May 26 2025Discount cards can save money but they also track what you buy.

Jinny Shin

May 29 2025It’s almost tragic how much data they collect – a silent watcher lurking behind every saved penny.

deepak tanwar

June 1 2025While privacy concerns are valid, the trade‑off for substantial savings on essential medications cannot be dismissed outright.

Abhishek Kumar

June 3 2025Fair point, though many just ignore the data issue and focus on the price.

hema khatri

June 6 2025Let’s be real – we need these cards because the system is broken, and whether you pick GoodRx or BuzzRx, you’re still beating the overpriced status‑quo, so grab one and start saving! 🇺🇸