Why Insurers Prefer Generic Drugs: How Formularies Control Costs and Shape Your Prescriptions

When you pick up a prescription, you might not think about why your doctor prescribed one pill over another. But behind the scenes, a complex system is deciding what you get-and how much you pay. That system is called a preferred generic list, and it’s the reason your $200 brand-name medication was swapped for a $12 generic version. Insurers don’t randomly choose these drugs. They use strict rules built into formularies to save money, manage risk, and keep premiums lower. But these rules aren’t always simple, and they don’t always work in your favor.

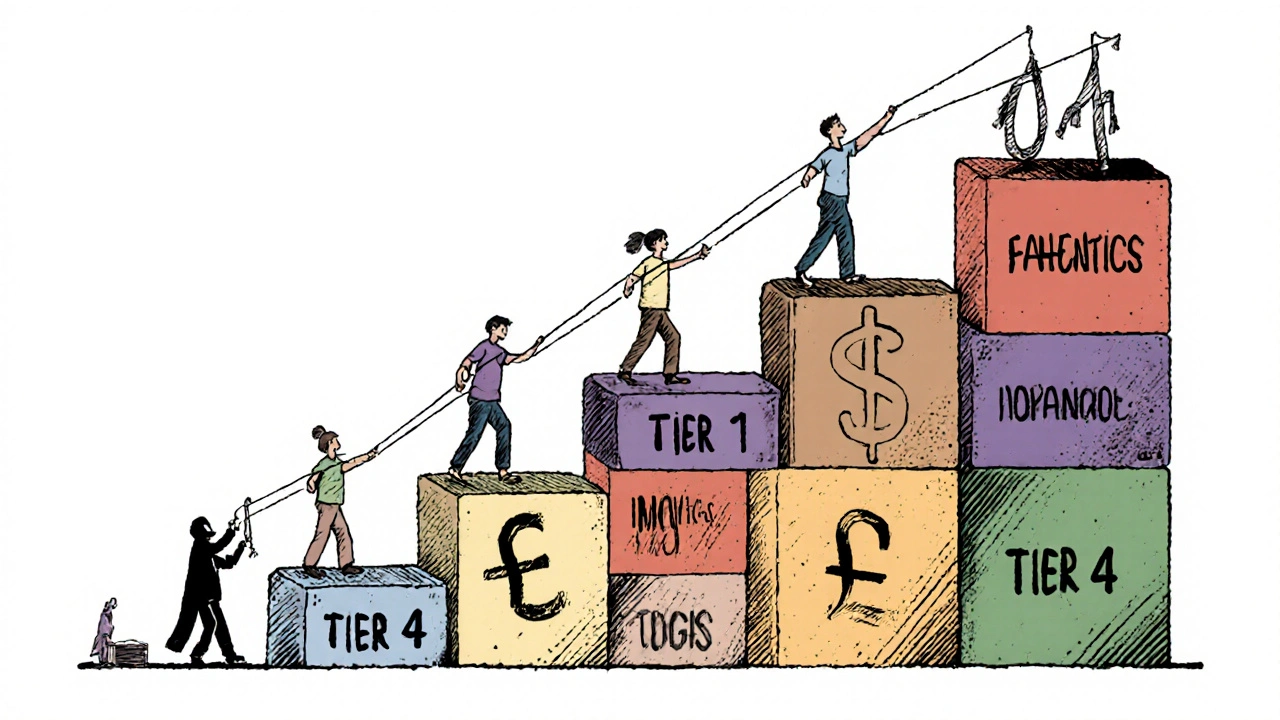

How Formularies Work: The Tiered System

Most health insurance plans use a tiered formulary to organize drugs by cost. Think of it like a ladder. The lower the step, the cheaper it is for you. Tier 1 is where preferred generics live. These are FDA-approved copies of brand-name drugs that work the same way but cost 80-85% less. For a 30-day supply, you might pay just $5 to $15. That’s not a discount-it’s a standard rate. Tier 2 usually holds preferred brand-name drugs or higher-cost generics. Copays here jump to $25-$50. Tier 3 is for non-preferred brand-name drugs, often costing $50-$100. And Tier 4? That’s where specialty drugs like biologics live. These can cost hundreds or even thousands per month, with coinsurance (a percentage of the price) instead of a flat fee. The Centers for Medicare & Medicaid Services (CMS) found that in 2023, 92% of Medicare Part D plans used a four-tier structure. Commercial insurers follow the same pattern. Why? Because it works. When a drug is on Tier 1, patients are far more likely to fill their prescriptions. Lower cost means better adherence. And better adherence means fewer hospital visits down the line.Why Insurers Push Generics: The Numbers Don’t Lie

The financial logic is simple. Generic drugs make up 90% of all prescriptions filled in the U.S., but they account for only 23% of total drug spending. That’s a massive gap. In 2023, the U.S. generic drug market hit $122.7 billion. That’s billions saved-mostly by insurers and patients. The savings get even steeper when multiple generic versions exist. The FDA found that when six or more companies make the same generic drug, prices can drop by up to 95%. Take levothyroxine, a common thyroid medication. One Reddit user reported dropping from $187 a month for the brand to just $12 for the generic. That’s not an outlier. It’s the rule. Pharmacy Benefit Managers (PBMs)-the middlemen between insurers and drugmakers-drive this system. They negotiate rebates and discounts. For brand-name drugs, they get 25-30% rebates. But for generics? They buy in bulk directly from manufacturers, cutting out the middleman entirely. That’s why CVS Health, Cigna’s Evernorth, and UnitedHealth’s OptumRx control nearly 80% of the PBM market. They don’t just manage prescriptions-they control pricing.When Generics Aren’t Enough: The Biosimilar Problem

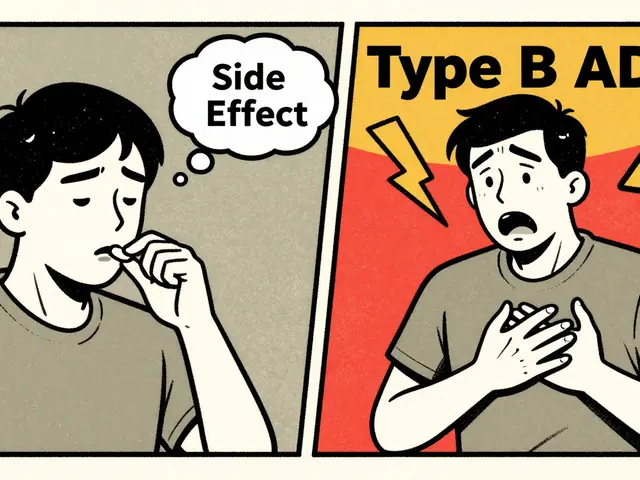

Not all drugs have generics. Biologics-complex drugs made from living cells, like Humira for arthritis or Enbrel for psoriasis-don’t have exact copies. Instead, they have biosimilars. These are highly similar but not identical. And here’s where the system breaks down. Insurers want to switch patients to biosimilars because they’re cheaper. But brand-name manufacturers offer co-pay assistance programs that cut your out-of-pocket cost to $0. Biosimilar makers rarely do. So even though a biosimilar might cost $850 a month versus $1,200 for Humira, you might still pay more because you lose your co-pay card. A 2023 Cigna report found that 44% of patients on biologics struggled with this switch. And it’s not just about money. In 2022, the FDA reported that 78% of brand-name biologic manufacturers offer financial help, while biosimilar makers do so in only 15% of cases. That’s a huge gap. Insurers don’t always account for it.

What Doctors Think: When Rules Override Judgment

Your doctor doesn’t pick drugs based on insurance tiers. They pick based on your history, allergies, and how you’ve responded to treatment. But formularies often override that. The American Medical Association found that 42% of physicians report delays in treatment because insurers force patients to try cheaper drugs first-what’s called “step therapy.” One patient with chronic pain might be forced to try five generic painkillers before getting the one that actually works. That’s not just frustrating-it’s dangerous. Dr. Scott Glovsky, an insurance specialist, put it bluntly: “Physicians know their patients best... it is unfortunate that physician decisions are questioned and altered by others who don’t understand unique patient circumstances.” Even when a doctor writes “dispense as written” on a prescription, pharmacists in 89% of states can still substitute a generic unless the doctor specifically blocks it. And 37% of patients don’t even know they have that option.What You Can Do: Navigate the System

You don’t have to accept whatever your plan gives you. Here’s how to take control:- Check your formulary every year during open enrollment. Your plan’s list can change without notice.

- Ask your pharmacist if a generic is available-even if your doctor didn’t prescribe one. They can often switch it at the counter.

- If your drug isn’t on the preferred list, ask your doctor to file an exception. In 68% of cases, these appeals succeed when backed by medical documentation.

- Use GoodRx or SingleCare to compare cash prices. Sometimes paying out of pocket is cheaper than using your insurance.

- Call your insurer and ask: “What tier is my medication on? Is there a cheaper alternative?” Most won’t volunteer this info.

The Bigger Picture: What’s Changing in 2025

The rules are shifting. Starting in 2025, Medicare Part D will require all plans to place biosimilars in the same tier as the brand-name drug they copy. That’s a big deal. It could push biosimilar use from 15% to 45% in just a few years. Also, the Inflation Reduction Act caps out-of-pocket drug costs at $2,000 a year for Medicare Part D enrollees by 2025. That’s going to push more people toward generics-because once you hit that cap, you’ll want the cheapest option. But there’s a catch. Some PBMs now use “accumulator adjuster” programs. These exclude manufacturer co-pay assistance from counting toward your out-of-pocket maximum. So even if you’re getting $500 off your Humira each month, that $500 doesn’t count toward your $2,000 cap. You still have to pay full price on other drugs. That’s a loophole insurers are using to keep costs down-while making patients pay more in the long run.Final Reality: It’s Not About You-It’s About the System

Insurers don’t prefer generics because they’re better. They prefer them because they’re cheaper. And in a system where profit margins are tight and premiums are rising, that’s not evil-it’s economic. But that doesn’t mean you’re powerless. The system works best when you understand it. You’re not just a patient. You’re a consumer. And you have rights: the right to ask, the right to appeal, the right to know your tier. The real win? When you switch to a generic and save $175 a month. That’s not luck. That’s knowledge.Why do insurance companies prefer generic drugs over brand names?

Insurers prefer generic drugs because they cost 80-85% less than brand-name versions, according to the FDA. When multiple generics are available, prices can drop by up to 95%. This lowers overall drug spending, which helps keep premiums and out-of-pocket costs down for everyone. Generics are required by the FDA to be bioequivalent to brand drugs, meaning they work the same way in the body.

What is a preferred generic list?

A preferred generic list is part of an insurance plan’s formulary-a list of covered drugs organized into tiers. Preferred generics are placed in Tier 1, the lowest-cost tier, meaning you pay the smallest copay-usually $5 to $15 for a 30-day supply. These are FDA-approved copies of brand-name drugs that are equally effective but significantly cheaper.

Can my pharmacist substitute a generic drug without my doctor’s permission?

Yes, in 89% of U.S. states, pharmacists can automatically substitute a generic drug for a brand-name one unless the doctor writes “dispense as written” on the prescription. Many patients don’t know this is an option. Always ask your pharmacist if a cheaper generic is available-even if your doctor didn’t prescribe one.

Why am I paying more for a biosimilar than expected?

Biosimilars are cheaper than brand-name biologics, but brand manufacturers often offer co-pay assistance programs that reduce your out-of-pocket cost to $0. Most biosimilar makers don’t offer these programs. So even if the list price is lower, your actual cost might be higher because you lose that financial help. This is a known issue with 44% of patients reporting difficulty switching to biosimilars.

What should I do if my insurance won’t cover my medication?

Ask your doctor to file a prior authorization or exception request. These appeals succeed in 68% of cases when supported by medical documentation proving the preferred drug won’t work for you. You can also check if a cash price via GoodRx is lower than your insurance copay. And always review your plan’s formulary during open enrollment-changes happen every year.

Are generic drugs really as safe and effective as brand names?

Yes. The FDA requires generics to prove they’re bioequivalent to the brand drug, meaning they deliver the same amount of active ingredient into your bloodstream at the same rate. In 2021, the FDA found therapeutic equivalence in 98.5% of approved generics. While some doctors hesitate with narrow-therapeutic-index drugs like warfarin, most generics are just as safe and effective.

12 Comments

Swati Jain

November 22 2025Oh wow, so insurers are just playing Tetris with our prescriptions now? 🤦♀️ Tier 1 generics? More like Tier 1 slavery. I got switched from my stable brand-name antidepressant to a generic that made me feel like a zombie on a treadmill. And when I asked? ‘It’s bioequivalent!’ Yeah, right. Bioequivalent to a paperclip. FDA says it’s fine, but my brain says otherwise. And don’t get me started on PBMs-they’re the real puppet masters. CVS owns my pharmacy, my insurer, and my dignity. #GenericGulag

David vaughan

November 22 2025Just wanted to say… I’ve been on levothyroxine for 12 years… switched to generic in 2018… and honestly? Zero difference. My TSH is perfect. I save $180/month. My cat gets extra tuna. 🐱💰 I know some people have issues, but for most of us? It’s fine. Don’t let fear-mongering stop you from saving money. Also, GoodRx is a game-changer. I use it every time. :)

David Cusack

November 24 2025Let us not confuse cost-efficiency with clinical efficacy. The FDA’s bioequivalence threshold of 80–125% AUC is statistically laughable when applied to narrow-therapeutic-index drugs. Warfarin, phenytoin, lithium-these are not interchangeable commodities. The system incentivizes substitution, not safety. And don’t even get me started on accumulator adjusters-those are financial engineering maneuvers masquerading as policy. This isn’t healthcare. It’s actuarial theater.

Elaina Cronin

November 26 2025I find it deeply troubling that patients are being treated as line items in a spreadsheet. The emotional and psychological toll of being forced to switch medications-especially for chronic conditions-is rarely acknowledged. I’ve seen elderly patients cry because they were told their stable medication was no longer covered. This is not a cost-saving measure. It is a systemic failure of compassion. We must demand accountability-not just from PBMs, but from legislators who enable this.

Willie Doherty

November 27 2025Per the 2023 CMS data, 92% of Part D plans use four-tier formularies. The median copay for Tier 1 generics is $10.50. For Tier 4 specialty drugs, median coinsurance is 33%. That’s a 30x cost differential. The marginal cost savings from generics is $11.2B annually. But the hidden cost? Non-adherence due to formulary confusion. A 2022 JAMA study showed 18% of patients discontinue therapy after a tier change. So while the system saves money, it also increases downstream utilization. Net societal cost? Debatable.

Darragh McNulty

November 28 2025Hey everyone-just wanted to say YOU’RE NOT ALONE 😊 If your insurance is making you feel like a lab rat, you have rights. Ask for exceptions. Use GoodRx. Call your pharmacist and say ‘I need to know if there’s a cheaper option.’ I helped my mom get her blood pressure med switched from $90 to $12-just by asking. It’s annoying, but it’s worth it. You got this 💪💊 #GenericWins

Cooper Long

November 29 2025Formularies are a rational response to unsustainable drug pricing. The U.S. spends 17% of GDP on healthcare-more than any other nation. Generics are not a loophole. They are a necessity. The alternative is rationing care entirely. The real issue is not the system-it is the lack of price regulation on brand-name manufacturers. PBMs are symptoms, not causes.

Sheldon Bazinga

November 30 2025LOL so now we’re all supposed to be pharmacy bros? ‘Check your formulary’? Bro, I work 60 hours a week and my kid has soccer. I don’t have time to become a PBM analyst. My doctor told me to take this pill. I take it. If the insurance wants to swap it? Fine. If I feel weird? I go back. End of story. Also why is everyone on here acting like they’re running the CDC? Chill. 🤷♂️

Sandi Moon

December 1 2025They’re not just pushing generics-they’re engineering dependency. Did you know that 83% of PBM rebates are retained by the middlemen? The savings never reach you. And the 2025 $2000 cap? It’s a trap. Accumulator adjusters ensure your manufacturer coupons don’t count-so you pay more out-of-pocket, then hit the cap faster, forcing you into even cheaper drugs. This is not healthcare. This is a Ponzi scheme disguised as insurance. The FDA? Complicit. The AMA? Silent. Wake up.

Kartik Singhal

December 1 2025Generic drugs? Sure. But let’s be real-most of them are made in China or India. Quality control? LOL. I’ve seen pills that crumble in my hand. The FDA approves them because they’re cheap. Not because they’re safe. And don’t even get me started on the ‘bioequivalent’ BS. If it was that identical, why do brand names cost 10x? Because they’re better. Always. 🇮🇳 #MadeInIndia #NotMyMedicine

Logan Romine

December 3 2025There’s a philosophical irony here: we treat drugs like commodities, but our bodies are not machines. You can’t swap serotonin reuptake inhibitors like you swap iPhone chargers. The system reduces human complexity to a spreadsheet cell. And yet, we call it progress. Maybe the real generic drug is empathy. But that’s not on any tier. 🤔

Mark Kahn

December 4 2025Just a quick tip: if your doctor writes ‘dispense as written,’ make sure they actually check the box on the prescription. Most don’t. I had a patient switch to a generic that gave her migraines-turned out the doctor forgot to block substitution. Simple fix, huge impact. Always confirm. And if you’re feeling overwhelmed? Ask your pharmacist for a free med review. They’re trained for this stuff. You’re not alone.