Formulary Tiers: How Your Insurance Decides Which Drugs Cost What

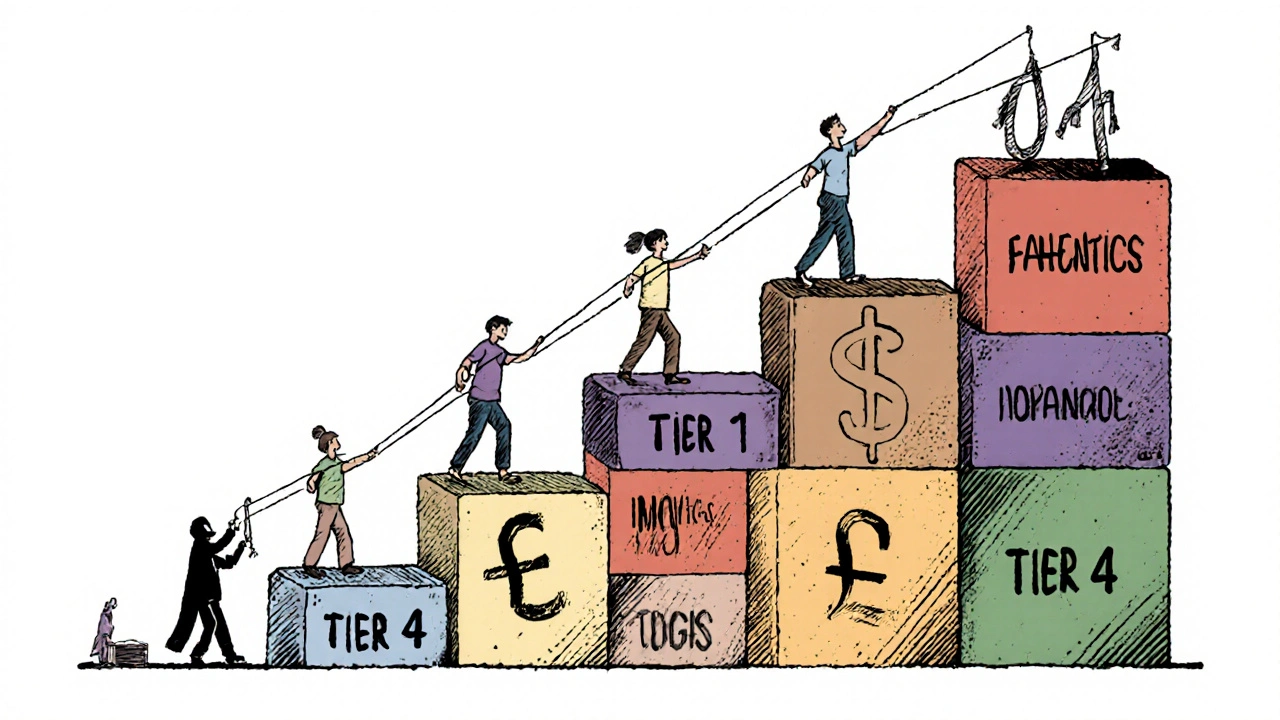

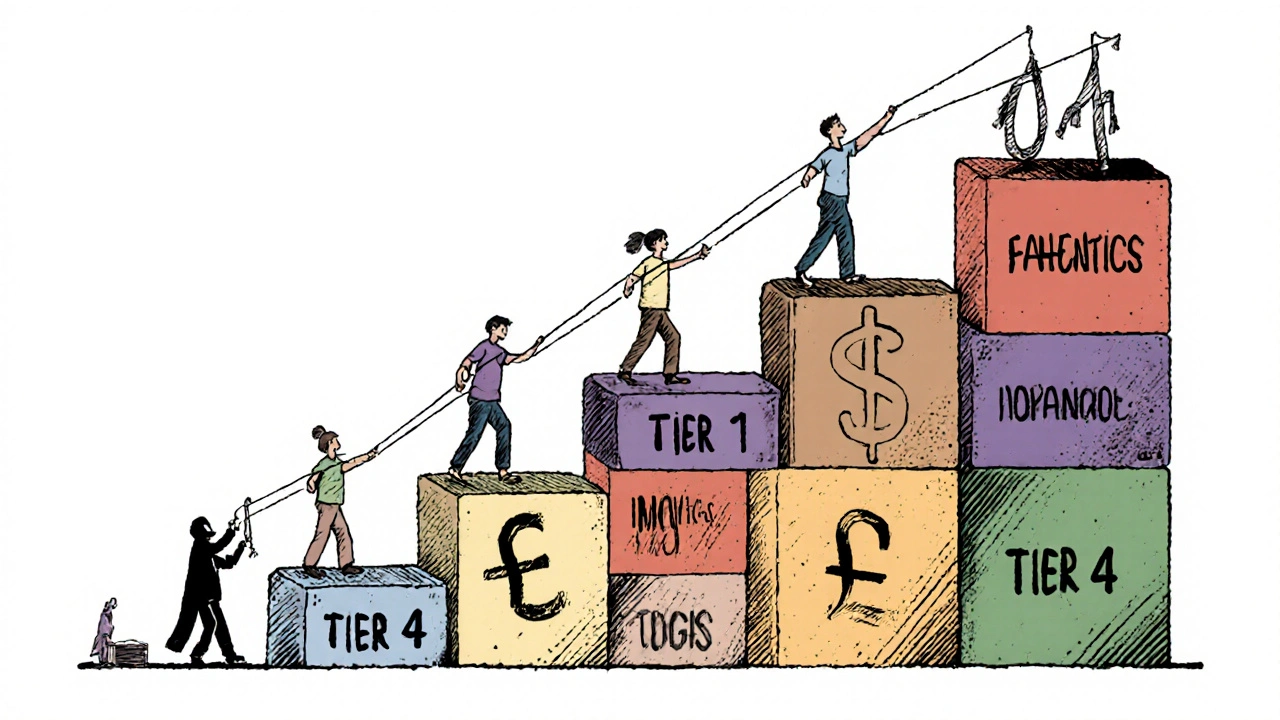

When you pick up a prescription, the price you pay isn’t just set by the drug company—it’s shaped by your insurance plan’s formulary tiers, a system that groups medications into levels based on cost and clinical use. Also known as drug tiers, it’s how insurers control spending and steer you toward cheaper or preferred options. If you’ve ever been shocked by a $200 co-pay for a drug you thought was covered, you’ve hit a high-tier drug. Not all drugs are treated the same. Some are in Tier 1—low cost, often generics. Others sit in Tier 4 or 5—brand names with no cheap alternatives—and cost hundreds.

Formulary tiers aren’t random. Insurers work with pharmacy benefit managers (PBMs) to decide which drugs go where. They look at price, effectiveness, and whether there’s a generic version available. A drug like levothyroxine, a common thyroid hormone replacement, usually lands in Tier 1 because it’s been around for decades, has many generic makers, and works reliably. But a newer GLP-1 agonist, a weight loss and diabetes drug with high demand and limited competition, might be in Tier 4 or 5 because it’s expensive and has no generic yet. This isn’t just about profit—it affects real choices. People skip doses or stop taking meds because they can’t afford Tier 3 or 4 drugs. That’s why understanding your formulary matters.

Not all plans are the same. Medicare Part D, employer plans, and Medicaid all have different formularies. Some include step therapy—you must try a cheaper drug first before they’ll cover the one your doctor prescribed. Others require prior authorization, meaning your doctor has to jump through hoops just to get approval. And if you’re buying meds overseas or through mail-order, your formulary might not cover them at all. You might not realize it, but your prescription costs, the amount you pay out of pocket for medications, are tied directly to these hidden rules. The good news? You can fight back. Ask your pharmacist for your plan’s formulary list. Check if there’s a cheaper alternative in a lower tier. Request a tier exception if your drug is essential and no other option works. Some people save hundreds a month just by switching to a Tier 1 version of the same medicine.

The posts below dig into real cases where formulary tiers make or break treatment. You’ll find stories about people stuck with high-cost drugs like prednisone, a steroid often used for inflammation but rarely covered without restrictions, and how drug interactions like levothyroxine and PPIs, a common combo that reduces absorption and forces higher doses can make coverage even trickier. You’ll see how kidney disease changes dosing, how generics carry legal risks for doctors, and why buying meds online doesn’t always bypass these barriers. This isn’t theory—it’s what happens when insurance rules meet real health needs. What you learn here could save you money, prevent side effects, or even keep you alive.

Insurers prefer generic drugs because they cut costs by up to 95% while maintaining effectiveness. Learn how formularies control prescriptions, why biosimilars are tricky, and what you can do to save money.

Continue Reading