What Is a Drug Formulary? Complete Guide for Patients on Costs, Tiers, and How to Navigate Coverage

A drug formulary is the list of prescription medications your health insurance plan will pay for - either fully or partially. It’s not just a catalog. It’s a tool that decides which drugs you can get at a low cost, which ones will cost you more, and which ones your plan won’t cover at all. If you’ve ever been surprised by a high pharmacy bill, or been told your doctor’s prescribed medication isn’t covered, you’ve run into the real-world impact of a formulary.

How Drug Formularies Work

Every health insurance plan - whether it’s Medicare Part D, Medicaid, or a private plan from your employer - uses a formulary to control costs and guide treatment. These lists aren’t random. They’re created by Pharmacy and Therapeutics (P&T) committees made up of doctors, pharmacists, and other healthcare experts. These teams review clinical data, safety records, and price negotiations with drug makers to decide which medications make the cut.

The goal? To make sure you get effective, safe drugs without paying more than necessary. But here’s the catch: not every drug is included. If your medication isn’t on the list, you might pay full price - or worse, get denied coverage.

The Tier System: What You Pay Depends on the Level

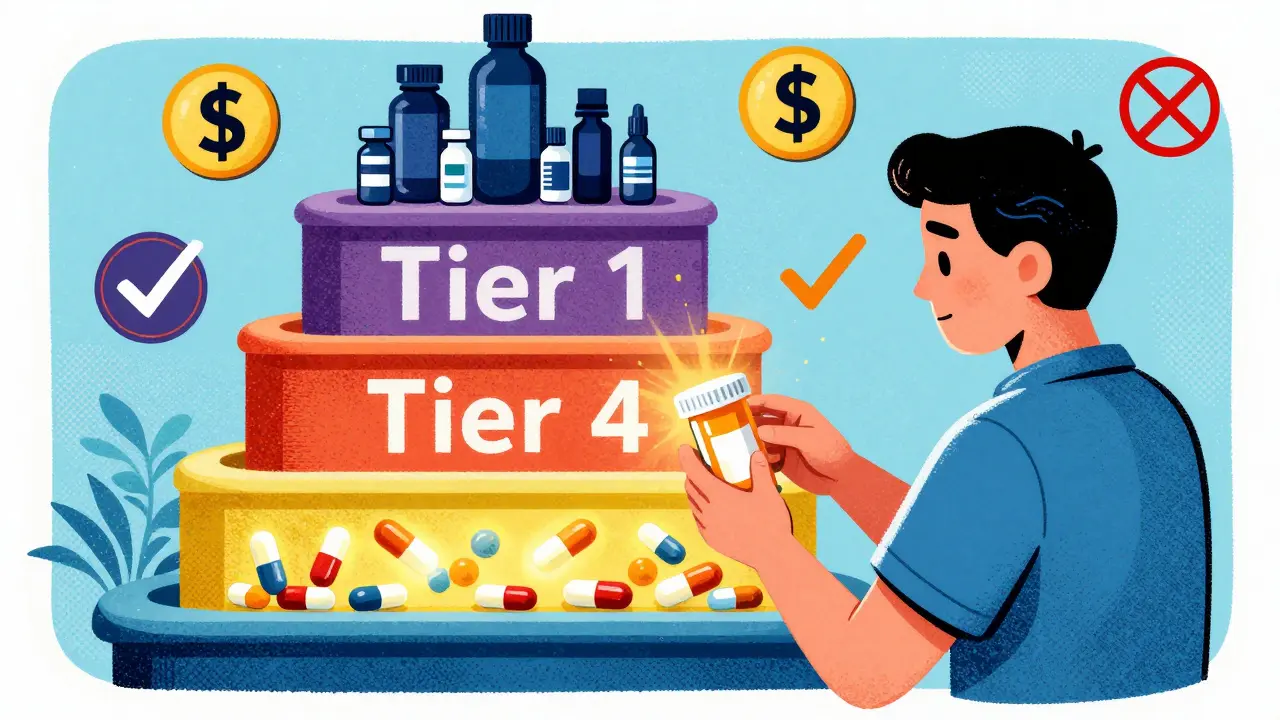

Formularies are organized into tiers. The higher the tier, the more you pay. Most plans use three to five tiers, and your out-of-pocket cost changes with each one.

- Tier 1: Generic Drugs - These are the cheapest. They’re chemically identical to brand-name drugs but cost a fraction. You’ll typically pay $0 to $10 for a 30-day supply. Most formularies require you to try generics first before approving brand names.

- Tier 2: Preferred Brand-Name Drugs - These are brand-name medications your plan has negotiated a better price on. You might pay $25 to $50 per prescription, or 15% to 25% coinsurance. These are often the first brand options your doctor can prescribe with good coverage.

- Tier 3: Non-Preferred Brand-Name Drugs - These are brand-name drugs without special pricing deals. Expect $50 to $100 per prescription or 25% to 35% coinsurance. Your plan may require you to try a Tier 2 drug first before approving this one.

- Tier 4: Specialty Drugs - These treat complex conditions like cancer, rheumatoid arthritis, or multiple sclerosis. They’re expensive - often costing hundreds or thousands per month. You’ll pay 30% to 50% coinsurance, with minimum copays of $100 or more. Some plans split this into Tier 4 and Tier 5 for the most costly drugs.

For example, a diabetes pill like metformin (generic) might be Tier 1 - $5 a month. But if your doctor prescribes a newer brand-name version like Januvia, it could be Tier 3 - $85 a month. That’s a 17x difference in cost.

Why Your Drug Might Not Be Covered

Just because a drug is FDA-approved doesn’t mean it’s on your formulary. Here’s why drugs get left out:

- Cost - If a drug is significantly more expensive than others in its class with similar results, it may be excluded.

- Limited evidence - New drugs without long-term safety or effectiveness data often don’t make the list right away.

- Step therapy rules - Your plan may force you to try cheaper drugs first. For example, you might need to try two generic blood pressure pills before they’ll cover the brand-name one your doctor wants.

- Prior authorization - Your doctor must submit paperwork proving you need this specific drug before the plan approves it.

- Quantity limits - Even if the drug is covered, you might only get 30 pills per month, not 90.

These restrictions aren’t just about saving money. They’re designed to prevent overuse, reduce side effects, and steer patients toward proven, cost-effective treatments. But they can also delay care.

Formularies Vary - Even Between Similar Plans

One big surprise for patients? Two Medicare Part D plans from the same insurer can have completely different formularies. A drug that’s Tier 2 on Plan A might be Tier 4 on Plan B - or not covered at all.

According to a 2022 Kaiser Family Foundation study, the same medication could cost you $15 one month and $150 the next - depending on your plan’s formulary. That’s why checking your formulary before enrolling in a plan is critical.

Here’s how it plays out in real life:

- Plan X covers Humira (a biologic for rheumatoid arthritis) on Tier 4 with a $95 copay.

- Plan Y doesn’t cover Humira at all - but covers a biosimilar version for $45.

If your doctor insists on Humira and you pick Plan Y, you’ll pay full price - around $2,000 a month. That’s why you can’t just pick a plan based on monthly premium. You have to check your specific drugs.

What to Do If Your Drug Isn’t on the Formulary

If your medication isn’t covered, you’re not stuck. You have options:

- Ask your doctor for an alternative - They might be able to switch you to a similar drug that’s on your formulary. Often, there’s a generic or preferred brand that works just as well.

- Request a formulary exception - Your doctor can submit a formal request to your insurer asking them to cover your drug anyway. They’ll need to explain why other drugs won’t work for you - maybe you had bad side effects, or previous treatments failed. In 2023, 67% of these requests were approved for Medicare Part D plans.

- Appeal a denial - If your exception request is denied, you can appeal. The process usually takes 72 hours for standard requests and 24 hours if it’s urgent.

- Switch plans during open enrollment - If your drug keeps getting denied, consider switching to a different plan next year. Use the Medicare Plan Finder or your insurer’s online tool to compare formularies before you enroll.

One patient on Reddit shared: “My insulin jumped from $35 to $85 a month when it moved to Tier 3. I had to switch to a different brand - and it worked just fine.”

Another said: “My cancer drug was on Tier 4, but my copay was $95 instead of $5,000. It saved my life.”

How to Check Your Formulary - Step by Step

You don’t need to be a medical expert to understand your formulary. Here’s how to check it:

- Find your plan’s formulary - Go to your insurer’s website. Look for “Drug List,” “Formulary,” or “Preferred Drug List.” Most plans post this online for free.

- Search for your medication - Type in the exact name (brand or generic). Don’t rely on the pill color or shape - use the official drug name.

- Check the tier and restrictions - See what tier it’s on and if there are prior authorization or step therapy rules.

- Compare plans during open enrollment - If you’re on Medicare, use the Medicare Plan Finder (medicare.gov/plan-compare) every October to compare formularies for next year.

- Call customer service - If you’re unsure, call your insurer. Ask: “Is [drug name] covered? What tier? Are there restrictions?”

Pro tip: Formularies change - sometimes mid-year. Your drug could move tiers or get removed. Always double-check before refilling.

What’s New in 2024-2025

Recent laws are changing how formularies work:

- Insulin cap - Since 2023, Medicare Part D plans must cap insulin at $35 per month. Many private plans have followed.

- Out-of-pocket cap - Starting in 2025, all Medicare Part D plans will have a $2,000 annual cap on out-of-pocket drug costs.

- Biosimilars - More affordable copies of biologic drugs are hitting the market. Formularies are adding them to lower costs.

- AI-driven formularies - By 2027, insurers may use AI to recommend drugs based on your medical history, not just cost.

These changes are making formularies more patient-friendly - but they’re still complex. Knowing how they work gives you power.

Bottom Line: Know Your Formulary, Save Money

A drug formulary isn’t a mystery. It’s a list - and you have the right to see it. If you’re on a chronic medication, take 10 minutes this month to look up your drugs. Compare them across plans if you’re switching. Ask your pharmacist or doctor if there’s a cheaper alternative on your formulary.

Remember: Just because your doctor prescribed it doesn’t mean your insurance will cover it. But if you know your formulary, you can avoid surprise bills, fight denials, and get the best price for your medications.

What happens if my drug is removed from the formulary?

If your drug is removed from the formulary, your insurer must notify you at least 60 days in advance. During that time, you can switch to a covered alternative, request a formulary exception, or wait until open enrollment to switch plans. Some plans offer a temporary 30- to 90-day transition supply to help you adjust.

Can I use a drug not on my formulary?

Yes, but you’ll pay full price - often hundreds or thousands of dollars per month. Some pharmacies may offer discount programs or coupons, but these won’t count toward your deductible or out-of-pocket maximum. It’s rarely a sustainable option unless it’s a short-term emergency.

Do all insurance plans have formularies?

Almost all. Private insurance, Medicare Part D, Medicaid, and VA plans all use formularies. The only exceptions are some very limited or short-term plans that don’t include prescription coverage. If your plan covers prescriptions, it has a formulary.

Why do some drugs cost more even if they’re the same?

Even if two drugs are chemically identical, one might be generic (Tier 1) and the other brand-name (Tier 3). The brand-name version costs more because the manufacturer charges more, and your insurer hasn’t negotiated a discount on it. Generics are required by the FDA to be identical in safety and effectiveness - they just cost less to produce.

Can my doctor override the formulary?

Your doctor can’t override the formulary directly, but they can request an exception on your behalf. If they provide strong clinical reasons - like allergies, previous treatment failures, or rare side effects - your insurer may approve the drug even if it’s not on the list. This is how many patients get access to non-formulary medications.

How often do formularies change?

Most formularies update annually on January 1, but changes can happen anytime. About 28% of changes occur outside of open enrollment - often due to new drugs, price negotiations, or safety alerts. Always check your formulary before refilling a prescription, even if you’ve used it for years.

13 Comments

Juan Reibelo

January 23 2026Just spent 45 minutes on my insurer’s website trying to find if my thyroid med’s still on Tier 2… turns out it moved to Tier 3 last month. No notice. No warning. Just… gone. I’m not mad; I’m just… disappointed. 😔

Viola Li

January 23 2026Let’s be real-formularies are just corporate cost-cutting dressed up as ‘patient care.’ If you’re not rich, you’re basically a guinea pig for insurance algorithms. They don’t care if your drug works-they care if it’s cheap.

Dolores Rider

January 25 2026THEY’RE LYING TO US!!! 🚨 I found out my insulin was switched to a ‘biosimilar’-but it’s NOT the same! My blood sugar spiked! I think Big Pharma and the insurers are working together to kill us slowly… with coupons!!! 💉😭

Vatsal Patel

January 25 2026Ah, the modern paradox: we live in an age of infinite choice, yet the one thing that matters most-our health-is reduced to a spreadsheet. The tier system isn’t medicine. It’s capitalism with a stethoscope. You’re not a patient-you’re a line item. And your suffering? Just a footnote in the quarterly report.

But hey, at least we get to choose between $85 and $120 a month. Freedom!

Meanwhile, the guy who invented metformin is probably rolling in his grave… while his heirs are on a yacht in Monaco.

Philosophy isn’t dead. It’s just been outsourced to the P&T committee.

Darren Links

January 26 2026Formularies are a scam. And don’t tell me ‘it’s for efficiency’-we’re talking about people’s lives here. My dad had to wait 3 months for an exception on his cancer drug. He nearly died waiting for paperwork. This isn’t healthcare. It’s a bureaucratic obstacle course with a price tag.

And now they want us to ‘compare plans’? Like we’re shopping for Netflix? Come on.

Kevin Waters

January 27 2026Hey-I’ve helped over 200 people navigate formularies, and the #1 thing people miss? The ‘step therapy’ trap. You think your doc’s prescribing the best drug? Not always. Your plan might force you to try 3 cheaper ones first-even if they’re useless for your condition.

Pro tip: When your doctor writes the prescription, ask them to add ‘DAW’ or ‘Do Not Substitute’ on the script. That forces the pharmacy to give you exactly what’s written.

Also-call your insurer BEFORE you fill. Don’t wait until the counter says ‘$187.’ You’ll thank me later.

Kat Peterson

January 29 2026OMG I JUST HAD A BREAKDOWN OVER MY RHEUMATOID ARTHRITIS DRUG!!! 😭😭😭 They moved Humira to Tier 5 and now I’m paying $2,000?! I cried in the pharmacy aisle like a Shakespearean tragedy. My cat even stared at me like I was losing my mind. And I was. 💔💊 #FormularyTrauma

Himanshu Singh

January 29 2026It’s okay to feel overwhelmed. I’ve been there. But here’s the truth: you’re not powerless. Formularies change-but so do you. You can ask. You can appeal. You can switch. You can fight.

And if you’re reading this right now? You’re already stronger than you think.

One step at a time. One formulary at a time. You got this. 🙏

Jamie Hooper

January 29 2026so i just found out my ‘preferred’ brand name med got axed… like… wtf? no one told me. now im paying 3x. and the pharmacy guy just shrugged. ‘its the system bro’… yeah, the system that’s literally designed to screw people.

Husain Atther

January 29 2026The structure of formularies reflects a broader tension in healthcare: between access and affordability. While the tier system may appear rigid, it is often the result of complex pharmacoeconomic modeling aimed at maximizing population health outcomes within finite resources. However, individual patient needs must not be subordinated to aggregate metrics. Transparency, patient advocacy, and regulatory oversight are essential to preserve equity.

Helen Leite

January 29 2026THEY’RE ADDING POISON TO OUR MEDS!!! I read a post that said ‘biosimilars’ are just copies… but what if they’re using different chemicals?? What if they’re testing on us?? I’m not taking it anymore!! 😱💊 #BigPharmaLies

Izzy Hadala

January 30 2026While the article provides a comprehensive overview of formulary mechanics, it lacks critical analysis of the ethical implications of tiered access to life-sustaining medications. The absence of discussion regarding distributive justice, the role of pharmaceutical monopolies, and the moral hazard inherent in cost-based formulary design renders the guide incomplete as a tool for patient empowerment.

Marlon Mentolaroc

February 1 2026Okay, let’s break this down. You’re telling me that if I’m on a $100/month drug and my insurer suddenly decides to make it Tier 4, I’m supposed to ‘ask my doctor for an alternative’? Great. Except my doctor already tried 5 alternatives. They all gave me seizures. So now what? Do I beg? Do I cry? Do I file a form in triplicate while my kidneys fail?

And don’t even get me started on ‘prior authorization.’ That’s just corporate gaslighting with a fax machine.

But hey-at least we’re not paying $5,000. Right? 😌