Insurance Formularies: What Drugs Are Covered and Why It Matters

When you pick up a prescription, what you pay isn't just about the drug—it's about your insurance formulary, a list of medications approved by your health plan for coverage. Also known as a pharmacy benefit list, it's the hidden rulebook that decides if you get your medicine at a low cost, a high cost, or not at all. Most people don’t realize their plan has a secret catalog of approved drugs. If your doctor prescribes something not on that list, you might be stuck paying full price—or worse, denied coverage entirely.

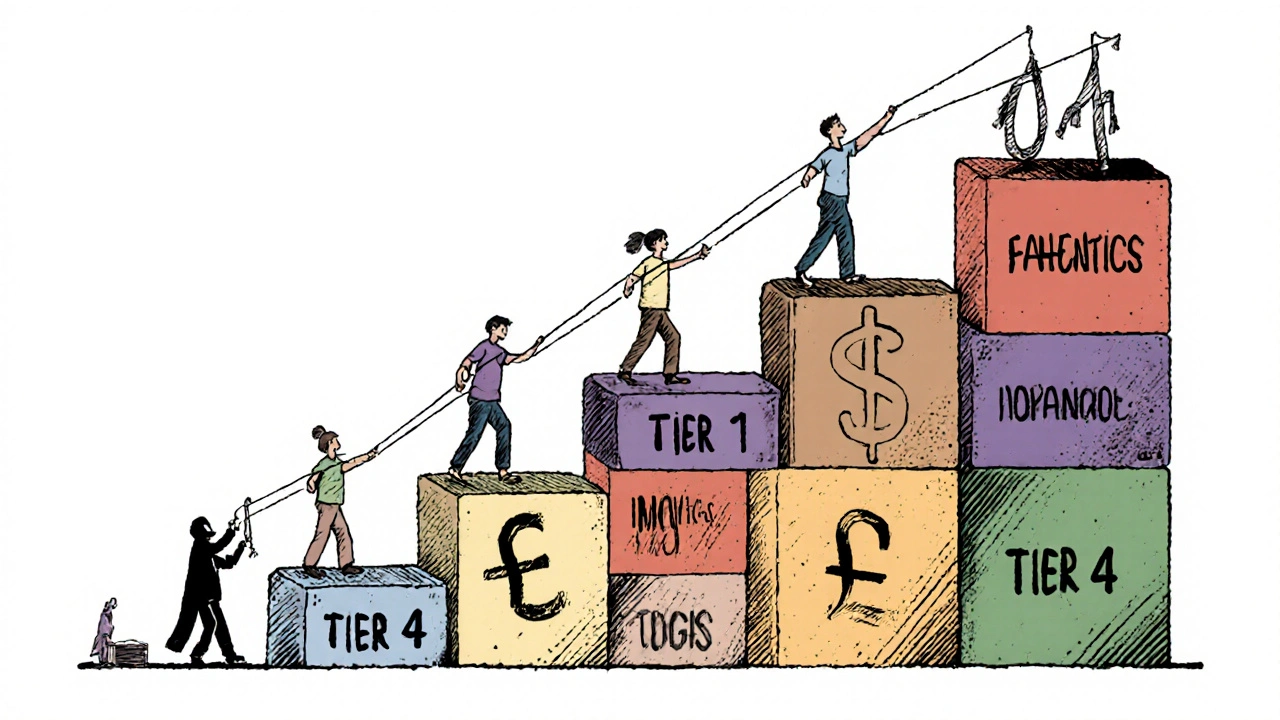

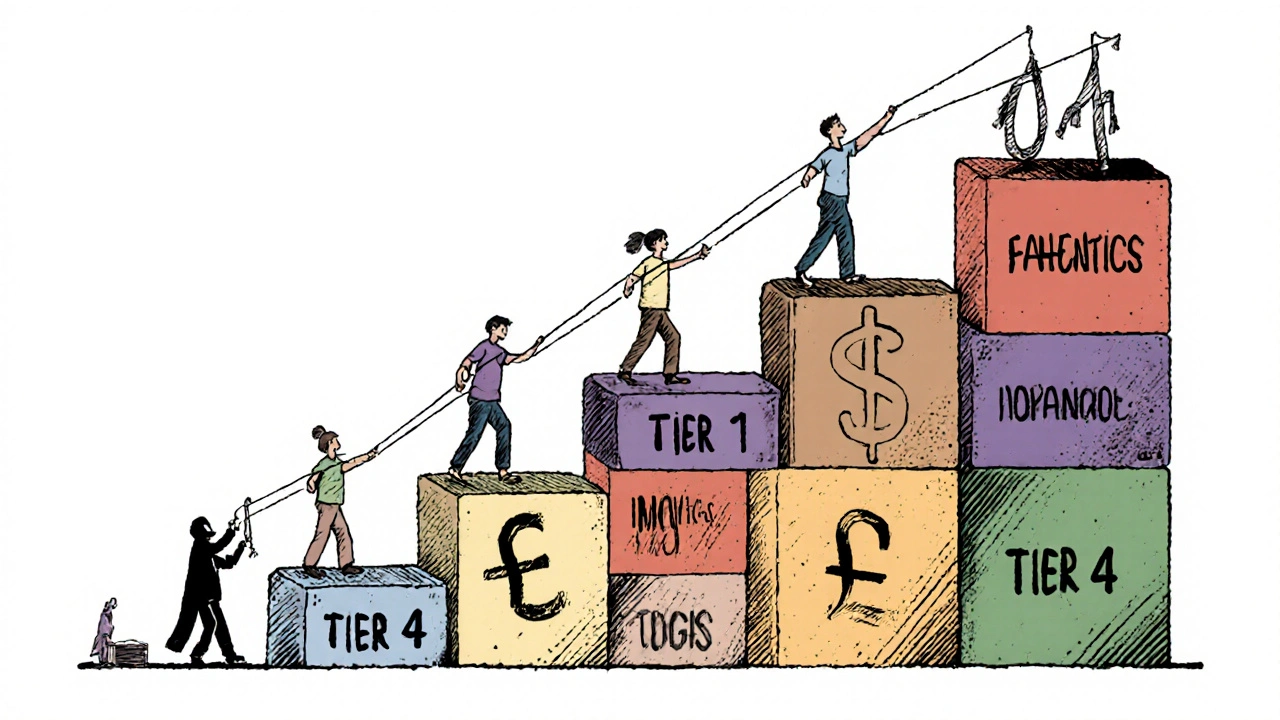

Formulary tiers, the ranking system that groups drugs by cost and preference, are what actually control your out-of-pocket expenses. Tier 1 usually means generic drugs with the lowest copay. Tier 2 might be brand-name drugs with moderate costs. But Tier 3 or 4? Those are the expensive specialty meds—sometimes requiring prior authorization, step therapy, or even a letter from your doctor just to get approved. And if a drug isn’t listed at all? You’re on your own. This isn’t random. Insurance companies negotiate deals with drug makers. If a drug pays better rebates, it climbs higher on the list. That’s why a cheaper generic might be preferred over a brand-name drug—even if they work the same way.

It gets trickier when you’re managing a chronic condition. Take levothyroxine, a thyroid hormone replacement—it’s usually on Tier 1, but if your plan switches manufacturers or adds a new restriction, your copay could jump overnight. Or consider GLP-1 agonists, weight-loss drugs like Ozempic. Even though they’re clinically proven, many formularies still block them unless you’ve tried cheaper options first. That’s step therapy—and it’s everywhere.

And it’s not just about price. Some formularies exclude drugs with serious side effects, like prednisone, a steroid known for mood swings and metabolic issues, or MAOIs, antidepressants with dangerous food and drug interactions. They’re not unsafe—they’re risky to manage without close supervision. So insurers make it harder to get them, not because they don’t work, but because they want to avoid complications that cost more later.

What you’ll find below are real stories and practical guides about how these rules affect real people. From how Lasix, a common diuretic gets restricted in Medicare plans, to why rosuvastatin, a cholesterol drug might be covered while another statin isn’t, these posts cut through the jargon. You’ll learn how to check your formulary, how to appeal a denial, and what to do when your medicine disappears from the list overnight. This isn’t theory—it’s what happens when insurance policies collide with your health.

Insurers prefer generic drugs because they cut costs by up to 95% while maintaining effectiveness. Learn how formularies control prescriptions, why biosimilars are tricky, and what you can do to save money.

Continue Reading