Preferred Generic Lists: What They Are and Why They Matter for Your Medications

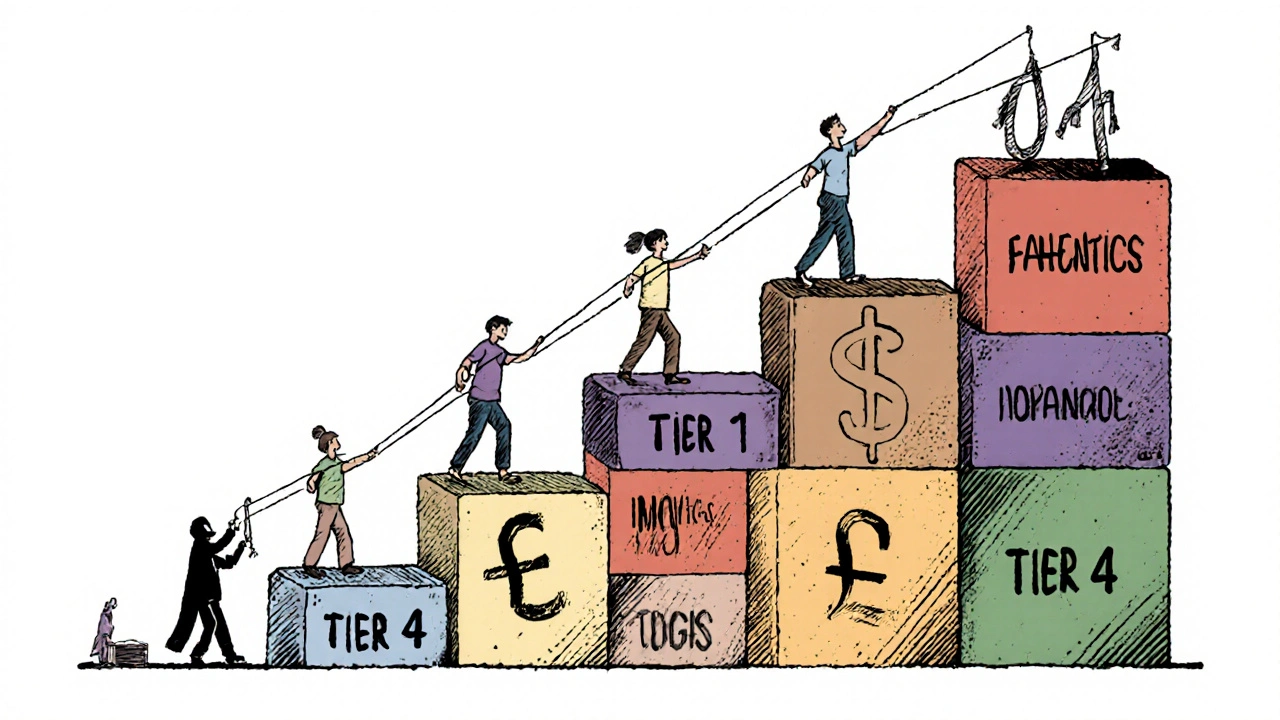

When you pick up a prescription, the pharmacy doesn’t always give you the brand-name drug you asked for. That’s because most insurance plans use preferred generic lists, a curated list of generic medications that insurers approve as cost-effective and clinically equivalent. Also known as formularies, these lists determine which drugs you pay the least for—and which ones might require extra steps to get. If you’re paying out of pocket or fighting with your insurer, understanding these lists can save you hundreds a year.

These lists aren’t random. They’re built by pharmacy benefit managers (PBMs) using real-world data on safety, effectiveness, and price. A drug makes it onto the list not because it’s cheap alone, but because it works just as well as the brand—and costs far less. For example, generic lisinopril replaces Prinivil or Zestril, and metformin replaces Glucophage. These aren’t just knockoffs; they’re identical in active ingredients, approved by the FDA, and used daily by millions. But not all generics are treated equally. Some plans put only one or two brands on their preferred list, forcing you to try them before approving others. That’s why your doctor needs to know your plan’s list before writing a prescription.

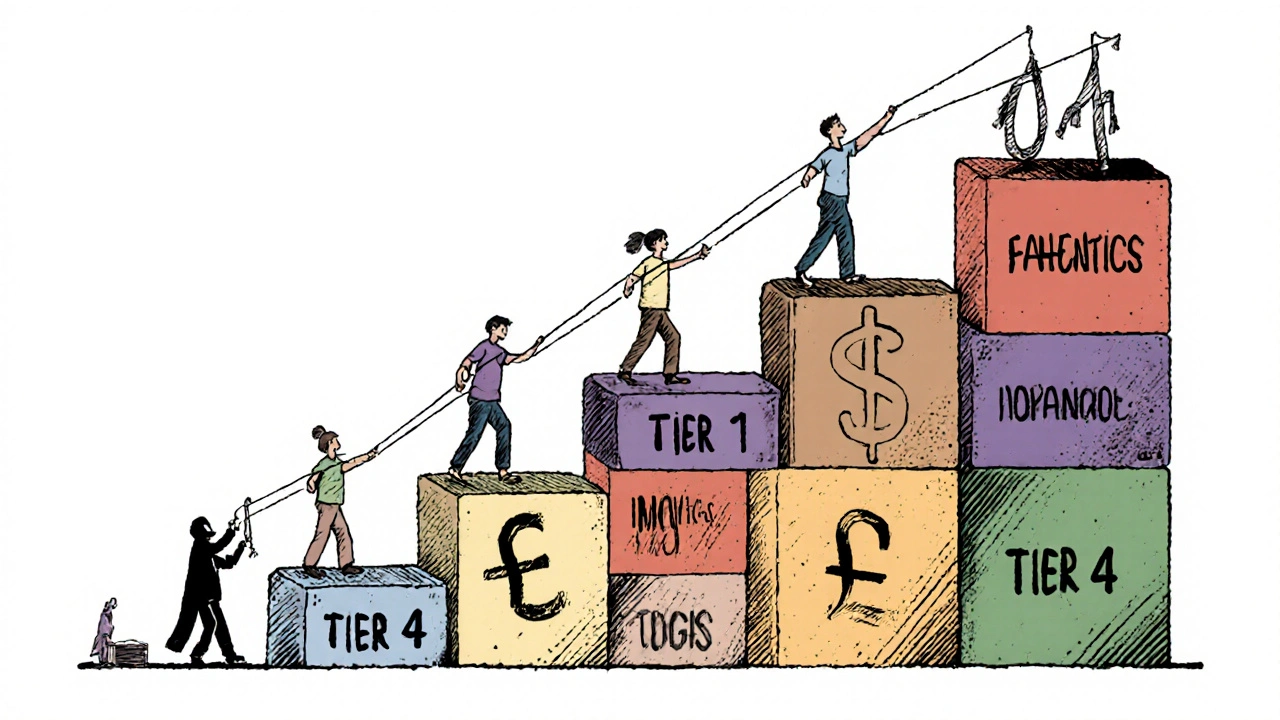

It’s not just about saving money. Preferred generic lists affect how your treatment flows. If your doctor prescribes a drug not on the list, your insurer might deny it outright—or make you pay 3x more. Worse, some patients stop taking meds because they can’t afford the co-pay. That’s dangerous. A study from the American Journal of Managed Care showed patients on non-preferred drugs were 40% more likely to skip doses. That’s why checking your plan’s list before your appointment isn’t optional—it’s a health move.

These lists also connect to bigger issues like physician liability and drug interactions. When a doctor prescribes a non-preferred generic, they’re not just risking cost—they’re risking legal exposure if something goes wrong. Generic manufacturers can’t be sued for side effects, so blame falls on the prescriber. That’s why some doctors stick strictly to preferred lists, even if a patient’s body responds better to another version. And if you’re on multiple meds, like levothyroxine and PPIs, the wrong generic could throw off your absorption. Your pharmacist can help you match your meds to the right generic on your list.

What you’ll find below are real stories and practical guides about how these lists shape your care. From how Lasix and prednisone interact with insurance rules, to why buying cheap generic Premarin online can be risky if it’s not on your formulary, these posts show you how to navigate the system. You’ll see how kidney disease changes dosing for generics, how antidepressants and statins are handled differently across plans, and why a simple switch to a preferred generic can mean the difference between sticking with treatment or quitting it.

Insurers prefer generic drugs because they cut costs by up to 95% while maintaining effectiveness. Learn how formularies control prescriptions, why biosimilars are tricky, and what you can do to save money.

Continue Reading